Standard Chartered is India's largest international bank with 99 branches in 42 cities, and they've been operating here since 1858. They build their products and services around you and have a number of commitments to help ensure that their customers have the best possible experience with them.

Standard Chartered Home Loan comes with an easy financing solution featuring low interest rates and unrivalled levels of service.

Features of Home Loan :

Great Savings : They offer variable and semi-fixed rate housing loans with just a one-time processing fee. No hidden charges

Tailored to your needs : Loans available for ready/under construction flat or house, home extension and renovation.

Flexible Tenure : It offers home loans for salaried and self-employed customers with a wide range of tenure, from 5 years to 20 years

Refinancing Options : You can also transfer your existing loan to a lower interest Standard Chartered Bank Home Loan and save money

Benefits :

Standard Chartered Home Loan comes with an easy financing solution featuring low interest rates and unrivalled levels of service.

Features of Home Loan :

Great Savings : They offer variable and semi-fixed rate housing loans with just a one-time processing fee. No hidden charges

Tailored to your needs : Loans available for ready/under construction flat or house, home extension and renovation.

Flexible Tenure : It offers home loans for salaried and self-employed customers with a wide range of tenure, from 5 years to 20 years

Refinancing Options : You can also transfer your existing loan to a lower interest Standard Chartered Bank Home Loan and save money

Benefits :

- Insurance Products:

- Home Loan Protector : Home Loan Protector is a product, which protects your family from the burden of repayment of the home loan in the unfortunate event of your death.

- Home Protector : HHP plan combines property and home content insurance in one policy. You can choose to take insurance for combinations of these components or for a single component. Home contents offers insurance for the belongings of the customer inside the house. Home Protector covers the property from damage due to natural calamities.

- Refinance your loan : Transfer your existing high interest loan to a lower interest Standard Chartered Bank home loan (as per the applicable current rates) and save on interest. We will also finance the prepayment charges if you so wish.

- Tax Benefits

- Top Up Loan

Pricing :

Effective MCLR as of 1 April 2016

Tenor MCLR

Overnight - 8.45%

1 month - 9.20%

3 month - 9.35%

6 month - 9.45%

1 year - 9.45%

2 year - 9.45%

3 year - 9.45%

>3 year - 9.65%

Indicative rates before April 1, 2016

Semi Fixed - 1 Year Variable

Home Loan – Normal 9.95% 10.10%

Fees and Charges:

1. Pre-closure fees - NIL fees on floating rate loans to individuals

For other* categories of loans:

Home loan - 2.5% of the principal outstanding**

*Includes fixed/ semi fixed rate loans, and loans to non-individuals also

**Here Principal outstanding refers to the principal outstanding at the time of

closure, as well as the amount part pre-paid in the same calendar year

which has not been charged

Pricing :

Effective MCLR as of 1 April 2016

Overnight - 8.45%

1 month - 9.20%

3 month - 9.35%

6 month - 9.45%

1 year - 9.45%

2 year - 9.45%

3 year - 9.45%

>3 year - 9.65%

Indicative rates before April 1, 2016

Semi Fixed - 1 Year Variable

Home Loan – Normal 9.95% 10.10%

2. Part pre-payment Fees - NIL fees on floating rate loans to individuals

For other* categories of loans:

• NIL for part pre-payments less than 25% of the principal outstanding in a calendar year Home loans

• For part pre-payments greater than 25% of principal outstanding in a calendar year - 2.5% of the entire amount being paid.

3. Processing Fees For loans < 25 lakhs, flat fee of INR 2,500

For loans > 25 lakhs, upto 1% of sanctioned amount, subject

to minimum of INR 10,000

4. Switch Fees - 0.75% of the principal outstanding.

5. Conversion Fees - 1.50% of the principal outstanding.

6. EMI cheque bounce

charges - 495/- per instance

MCLR/Base Rate/Benchmark Prime Lending Rate :

Marginal Cost of funds based Lending Rates (MCLR)

All rupee loans sanctioned and credit limits renewed with effect from 1 April 2016 shall be priced with reference to the MCLR, which will be the internal benchmark for such purposes.

Base Rate

Base Rate of the Bank is 9.75% p.a. with effect from August 7, 2014

The Base Rate has been arrived at considering the 6 - 9 months Term Deposit rate blended with Current and Savings Account (CASA) cost, and other elements that are common across all categories of borrowers. For customers whose interest rate is linked to Base Rate, any revision in the Base Rate will impact the interest rate.

The margin between your variable rate of interest and base rate will be determined by factors such as credit grading of the customer, quality of the collateral, risk profile of the industry/sector, account behaviour / conduct, product level allocable costs etc. and changes in these factors may result in upward or downward revision of the margin.

Mortgage Variable Reference Rate :

The interest rate on your floating rate Mortgage loan is linked to the Mortgage Variable Reference Rate (MVRR) and any revision in this rate would impact your interest rate. The MVRR, effective August 7, 2014 stands as:

Home Loan MVRR is 19.75%

Loan Against Property MVRR is 20.75%

Home Savers :

Along with Home Loans, Standard Chartered provides Home Saver service too.

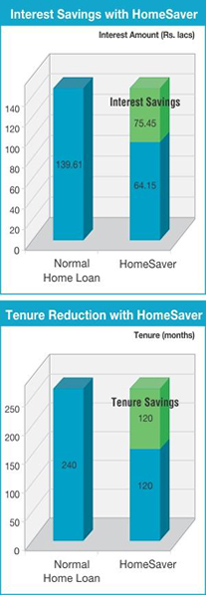

HomeSaver is a unique home loan that enables you to pay your home loan in half the time, at half the cost. With a HomeSaver loan, interest is calculated on daily balance and applied monthly.

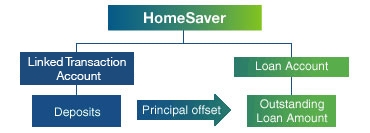

How it works :

A linked Transaction Account will be associated with your Home Loan.

The surplus money in your Linked Transaction Account will be used to offset the principal of your home loan, which will result in faster closure of your loan.

Effectively, interest will be paid only on the difference between the outstanding loan amount and your surplus funds.

The chart below demonstrates how HomeSaver works:

Thank you for sharing such great information. It is informative, For More Details Visit: Online Home Loan

ReplyDelete